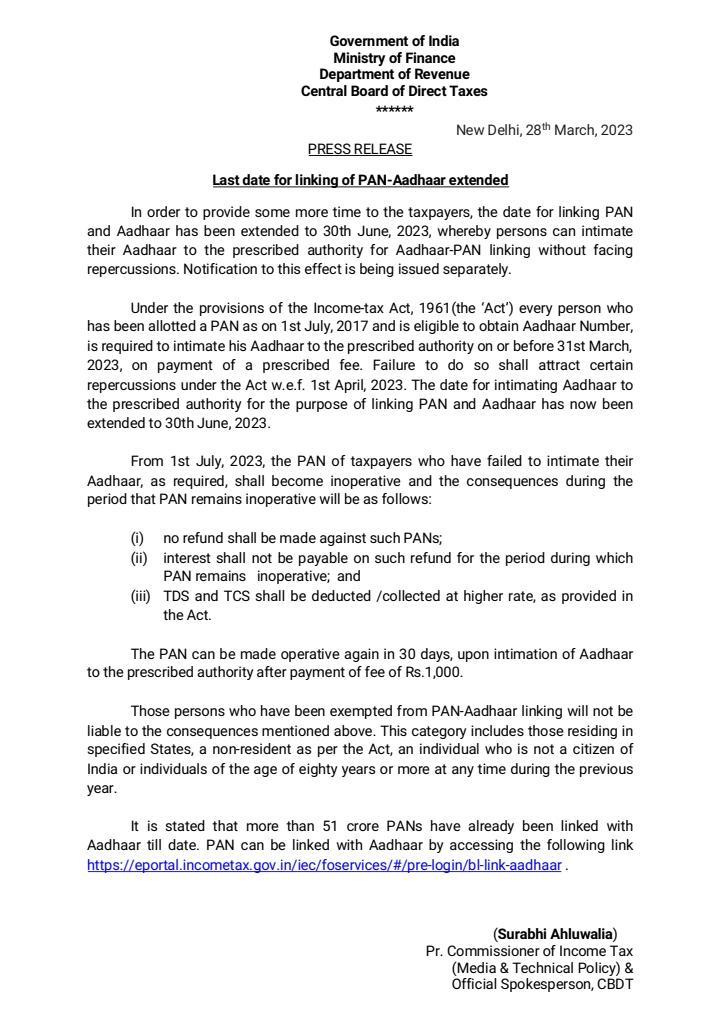

As per the government’s mandate, all citizens with a PAN card are required to link it with their Aadhaar card by June 30, 2023. Failure to do so will result in a late penalty fee of Rs. 1,000 before requesting the linking process. Additionally, if the PAN-Aadhaar linking is not completed by the deadline, the PAN card will become inoperative from July 1, 2023. Therefore, it is important to ensure that your PAN card is linked with your Aadhaar card before the deadline.

An Aadhaar card is a unique identification number issued to every resident of India by the Unique Identification Authority of India (UIDAI). The card contains a 12-digit number that is used to access the cardholder’s details from the government database, including biometrics and contact information.

Any resident of India, regardless of age or gender, can voluntarily enroll to obtain an Aadhaar number free of cost. Once enrolled, an individual’s details are permanently stored in the database, and they cannot obtain multiple Aadhaar numbers.

How to check PAN link with Aadhaar

“Check Your PAN-Aadhaar Linking Status: Two Simple Methods to Verify”

There are a few ways to check the linking status of your PAN with Aadhaar. Here are two simple methods:

- Check PAN-Aadhaar linking status online:

- Go to the Income Tax Department’s e-filing website (https://www.incometax.gov.in/).

- Click on the “Link Aadhaar” option under the “Quick Links” section.

- Enter your PAN and Aadhaar number in the respective fields.

- Click on the “View Link Aadhaar Status” button to check the status of your PAN-Aadhaar linking.

- Check PAN-Aadhaar linking status through SMS:

- Type UIDPAN (in capital letters) <SPACE> 12-digit Aadhaar number <SPACE> 10-digit PAN number and send the SMS to 567678 or 56161 from your registered mobile number.

- If your PAN is linked with Aadhaar, you will receive a confirmation message from the Income Tax Department.

Please note that it is mandatory to link your PAN with Aadhaar before the deadline set by the Income Tax Department, which is currently March 31, 2023. If you have not linked your PAN with Aadhaar yet, you should do so as soon as possible to avoid any penalties or consequences.

“Quick and Easy: How to Check Your PAN-Aadhaar Link Status via SMS”

You can check the PAN-Aadhaar linking status by sending an SMS from your registered mobile number to 567678 or 56161. Here are the steps to follow:

- Open the messaging app on your mobile phone.

- Type UIDPAN (in capital letters) followed by a space.

- Enter your 12-digit Aadhaar number followed by another space.

- Enter your 10-digit PAN number and send the SMS to 567678 or 56161.

- Wait for a few minutes to receive a reply message from the Income Tax Department.

The message will inform you about the status of your PAN-Aadhaar linking. If your PAN is linked with Aadhaar, the message will confirm the same. If your PAN is not linked with Aadhaar, the message will provide instructions on how to link them.

Please note that standard SMS charges may apply, and you should ensure that you are sending the SMS from your registered mobile number.

“Linking PAN with Aadhaar is Free: Here’s How to Do it Before the Deadline”

There are no charges to link your PAN with Aadhaar. It is a free service provided by the government of India to facilitate the integration of PAN and Aadhaar data.

You can link your PAN with Aadhaar online through the Income Tax Department’s e-filing website or through other modes such as SMS or offline submission of forms. However, it is important to ensure that you link your PAN with Aadhaar before the deadline set by the Income Tax Department, which is currently March 31, 2023, to avoid any penalties or consequences.

You should be cautious of any fraudulent messages or calls claiming to offer PAN-Aadhaar linking services for a fee. It is always advisable to verify the authenticity of such claims and to use official channels provided by the government to link your PAN with Aadhaar.

If you have any doubts or concerns, you can contact the Income Tax Department’s customer care or visit your nearest Taxpayer Service Center for assistance.

“Any resident of India, regardless of age or gender, can voluntarily enroll to obtain an Aadhaar number free of cost. Once enrolled, an individual’s details are permanently stored in the database, and they cannot obtain multiple Aadhaar numbers. Deadline Alert: Link Your PAN Card with Aadhaar Card by June 30, 2023”

As per the government’s mandate, all citizens with a PAN card are required to link it with their Aadhaar card by June 30, 2023. Failure to do so will result in a late penalty fee of Rs. 1,000 before requesting the linking process. Additionally, if the PAN-Aadhaar linking is not completed by the deadline, the PAN card will become inoperative from July 1, 2023. Therefore, it is important to ensure that your PAN card is linked with your Aadhaar card before the deadline.

“Trouble Checking Your PAN-Aadhaar Linking Status Online? Here are Some Possible Solutions”

I’m sorry to hear that. The online link to check PAN-Aadhaar linking status is maintained by the Income Tax Department of India, and it is possible that the link may be down temporarily due to technical issues or maintenance.

However, you can try again later to see if the link is up and running. Alternatively, you can check your PAN-Aadhaar linking status by logging in to your account on the Income Tax Department’s e-filing website using your PAN number and password. Once you have logged in, you can go to the “Profile Settings” section and click on “Link Aadhaar” to check the status of your PAN-Aadhaar linking.

If you are still facing issues, you can contact the Income Tax Department’s customer care or visit your nearest Taxpayer Service Center for assistance.

How to Link Aadhaar Card and PAN Card: Step-by-Step Guide

Here is how you can link your Aadhaar card with your PAN card:

- Online method: Visit the Income Tax Department’s e-filing website (https://www.incometax.gov.in/). Click on the “Link Aadhaar” option under the “Quick Links” section. Enter your PAN and Aadhaar number in the respective fields. Enter your name as mentioned in the Aadhaar card. Click on the “Link Aadhaar” button. A pop-up message will appear confirming the linking of your Aadhaar with PAN.

- SMS method: Type UIDPAN (in capital letters) <SPACE> 12-digit Aadhaar number <SPACE> 10-digit PAN number and send the SMS to 567678 or 56161 from your registered mobile number. If your PAN is linked with Aadhaar, you will receive a confirmation message from the Income Tax Department.

- Offline method: Download the form for linking PAN with Aadhaar from the Income Tax Department’s website. Fill in the required details, including your PAN and Aadhaar number, name as mentioned in the Aadhaar card, and sign the form. Submit the form at any PAN service center or NSDL e-Governance office.

Please note that it is important to link your PAN with Aadhaar before the deadline set by the Income Tax Department, which is currently June 30, 2023.